In the recent restructuring plans of the seven companies within the Lifeways Group (Listrac Midco Ltd & Others. Re [2023] EWHC 78 (Ch), Justin Tydeman, the former CEO of the Lifeways Group and the director of each of the plan companies, wished to participate in a meeting, via a separate class of creditor, to vote under part 26A. His issue, as put forward by counsel, was that he – along with the other B shareholders who had the benefit of a put option – should be entitled to participate in a meeting as their rights were being affected by the various plans. The court however disagreed and found that the rights of Mr Tydeman (and the other B shareholders) and/or the economic value of those rights were not going to be affected. It wasn’t so much that the rights had no economic value, simply that they were not affected by the plans.

An overview

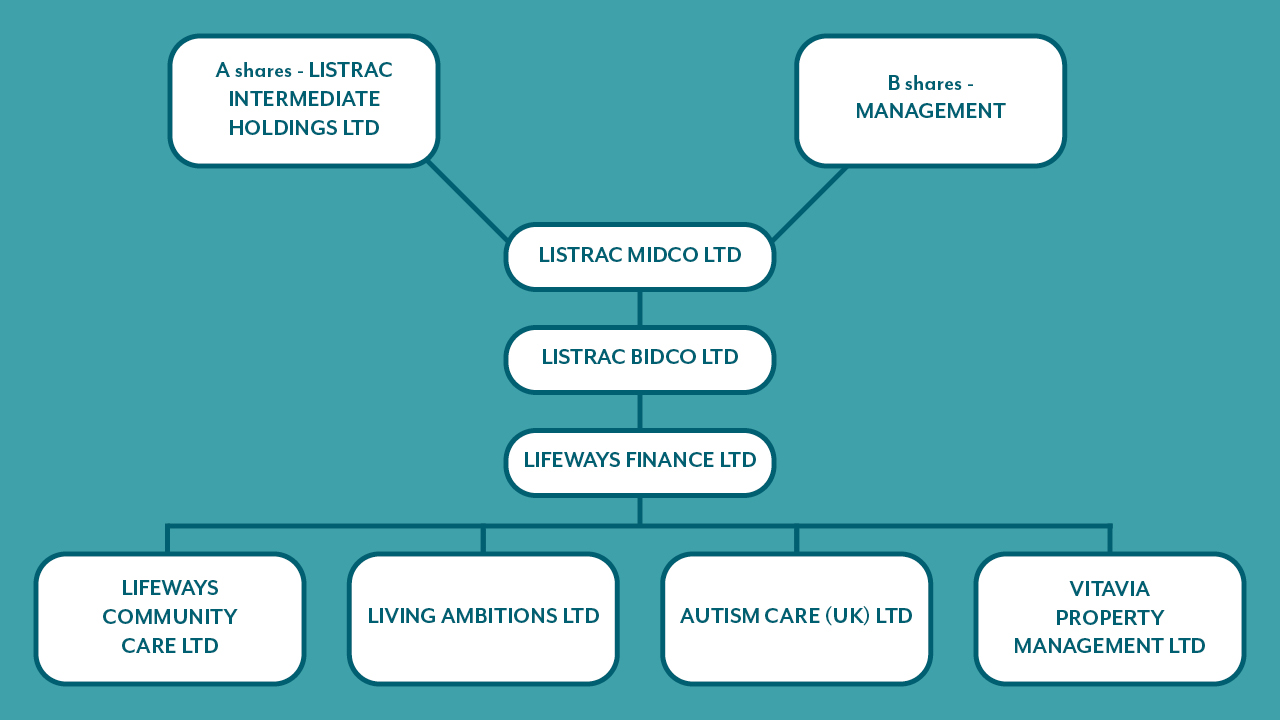

The Group were experiencing serious financial difficulties and the intentions of the plans was to allow for a restructure. A number of onerous leases and other onerous contracts were reduced and/or released and that parts of the group was to be transferred to the secured creditors in exchange for a reduction of its debts. To complete the restructure, Midco was to be wound down solvently and the secured creditors were to acquire its shareholding in Bidco for £100 million (to be set off against their remaining liabilities).

How this affected Mr Tydeman’s rights

The B shareholders had a put option so that when an exit (as defined within both the finance documents and the restructure plan) occurred, this would trigger a sale. The value to be paid for the B shares was ultimately dependent upon achieving a sale of the Bidco shares in a sum in excess of £116 million, as otherwise the put option would amount to £1. If, however, the sale exceeded the £116 million, then the sum to be paid would be substantially more than this. Mr Tydeman also claimed there were certain rights under an intercreditor agreement

His argument was, adopting the decision of Zacaroli J in Re Hurricane Energy Plc [2021] EWHC 1418 (Ch) who gave a broad meaning to the words ‘affected by’, that his (and the B shareholders) rights were affected by the plans. When the Group went through the restructuring, Bidco’s shares – held by Midco – were planning to sell for £100 million , which would be set off against Midco’s liabilities to the secured creditors. The Group had received previous offers of at least £130 million and Mr Tydeman argued that, had these been accepted, the rights of the B shareholders would have been triggered and they would have, for various reasons, been paid ahead of the secured creditors from the sale proceeds. In addition to this, he also argued that as the Midco shares were valued in the region of £117-130 million, the proposed sale at £100 million was a TUV.

The court’s decision

The court acknowledged Mr Tydeman’s arguments but, ultimately, rejected them. For the B shareholders to achieve a sum in excess of £1, a sale in excess of £116 million would have to be achieved but this was never going to happen. Furthermore, the valuation of £117-130 million was not of Bidco’s shares in Midco but was in fact an enterprise value for the group. Further, the court viewed that previous offers would not have settled the secured creditor’s indebtedness and nor would the alternatives to the plans have put Mr Tydeman ‘in the money’.

Finally, the court disagreed that the intercreditor agreement was being varied without Mr Tydeman’s consent, as what was intended was for a new intercreditor agreement to be put in place following the exit event and as part of the implementation of the plans.

The court took the view that the rights of the B shareholders themselves and/or the economic value of those rights, were not going to be affected by the plans. What is clear from the decision, and from a very fact specific situation, is that whilst the court was prepared to give a broad meaning to how rights are affected, a creditor is still going to have to establish that they were ‘in the money’.