The 2025 Budget introduces major reforms to Employee Ownership Trusts (EOT) – here’s what they mean for your business.

What is an Employee Ownership Trust?

Introduced by the UK government in 2014, an EOT is a corporate structure that allows owners to sell a controlling interest in their company to a trust, held for the benefit of the company’s employees.

EOTs are typically used as a succession planning tool for business owners who want to retire or exit while ensuring the business remains independent and giving employees a stake in its future.

Government concerns and 2025 Budget reforms

A major driver of EOT growth has been the availability of full capital gains tax (CGT) relief on qualifying sales. As CGT rates have increased in recent years, EOTs have become more attractive.

The expansion of EOT structures has not gone unnoticed by HMRC. The cost of the existing CGT relief has risen significantly, with government forecasts indicating that without intervention, it could cost around £2bn by 2028–29, far exceeding original expectations.

In response, the government has introduced a major reform to the EOT tax regime, effective 26 November 2025:

- 50% of the gain on disposal to the trustees of an EOT will now be treated as the seller’s chargeable gain for CGT purposes

- The remaining 50% of the gain will not be chargeable at the time of disposal but will continue to be held over and charged on any future disposal of shares by trustees of the EOT.

Does the EOT model still make sense?

Although the reform reduces the level of tax relief available, selling to an EOT can still provide meaningful CGT savings. Under current rates, an effective CGT rate of up to 12% on qualifying sales remains significantly lower than the standard rates, which can be up to 24% and may rise.

However, it does reduce their attractiveness, especially as the consideration payable on an EOT sale is often spread over a longer timeframe and the day-one payment is low. In view of the higher tax rate, businesses may consider an EOT transaction alongside a conventional exit process.

Benefits of EOTs

Many business owners choose an EOT for reasons that extend well beyond tax:

- Succession planning benefits

- Ensures continuity and protects the business’s independent future

- Provides a structured, controlled exit for shareholders and avoids the disruption that can accompany third-party sales.

- Employee and cultural benefits

- Employees benefit directly from the company’s success, including via the income tax-free bonus available in EOT-owned companies

- Reinforces an ownership mindset and alignment between management and staff

- Helps attract and retain talent in a competitive market.

How we can help

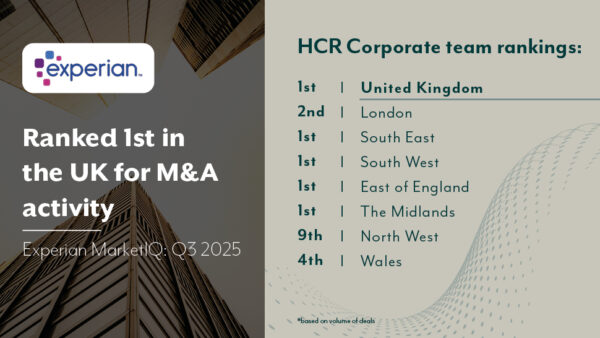

Our Corporate team has extensive experience supporting businesses in their transition to EOTs. We draft essential documents such as trust deeds, which define the governance structure of the EOT; articles of association, outlining the rules for managing each company; and share purchase agreements, detailing how shares are transferred and at what price.

Our EOT specialists within the Corporate team have worked across various industries, including care, communications and law, with a combined value of £100m. They have helped numerous companies achieve their goals and successfully transition to employee ownership.

How can we help you?

"*" indicates required fields