The UK has rebounded well from particularly troubling economic times. Unfortunately, all indications are that neither the UK nor the wider world economy is out of the woods yet as less developed nations continue to struggle.

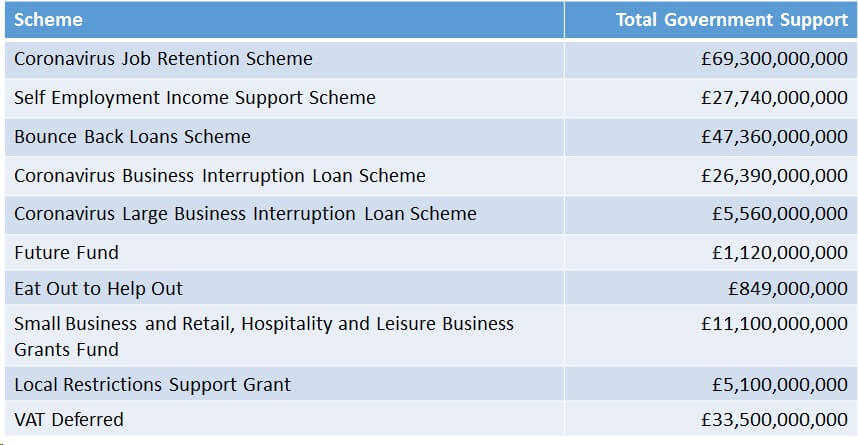

One only needs to look at the extent of government borrowing and funding associated with Covid-19 to understand the difficulties we may yet face.

*Coronavirus business support statistics published by the House of Commons as at October 2021 – https://researchbriefings.files.parliament.uk/documents/CBP-8938/CBP-8938.pdf

In total it is estimated that over £370bn of government support was provided to support the UK economy.

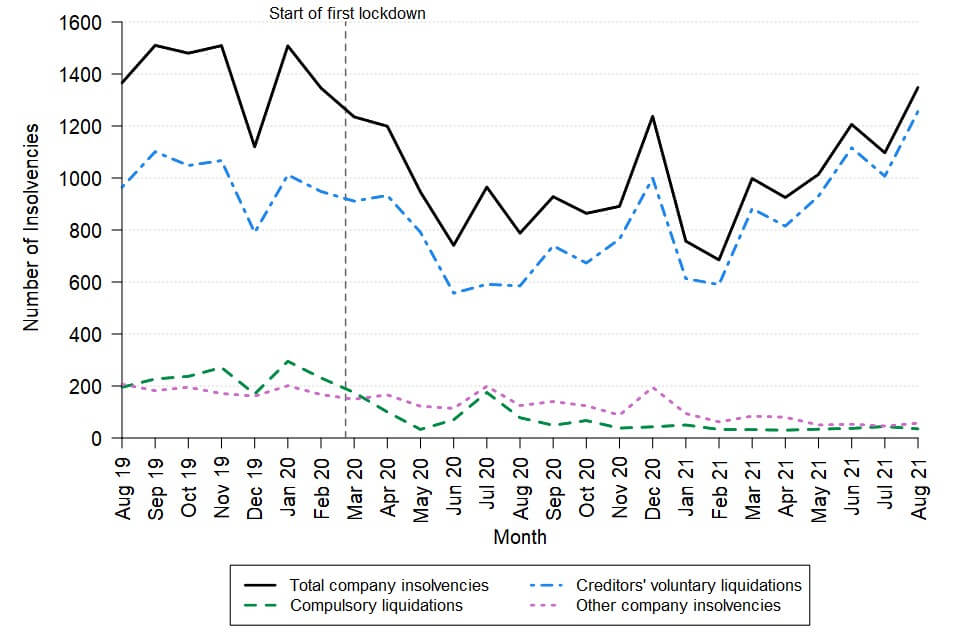

The effect of the funding packages should not be underestimated, as they were ultimately successful in suppressing the failure of numerous companies and trading entities. As a result, the UK economy saw its lowest rate of insolvencies since 1989.

But how long can we expect this to continue?

Set out below is an illustration of insolvency rates throughout the pandemic which illustrates that overall insolvencies have only recently returned to pre-pandemic levels.

With more than a third of small and medium sized enterprises (SMEs) relying on some form of government support, it is anticipated that the majority of companies have accrued significant liabilities – be it a government support loan, deferred tax arrangements or rental arrears. It is forecast that insolvency rates will increase significantly to reflect this in 2022, despite the government’s promotion of negotiation and forbearance amongst debts associated with Covid-19.

And we haven’t even mentioned the delayed effect of Brexit…

What are the early warning signs?

All indications are that we should expect a considerable amount of distress in our supply chains moving forward.

Identifying and capitalizing on an early sign of distress or insolvency might be the difference between preserving your supply chain and recovering any goods or money owed or suffering significant damage to your own goodwill as a result of delays and expensive disputes. What are those early warning signs?

- Highly leveraged accounts and finances – large accumulated debt or balance sheet insolvency

- Regular delays on deliver of service or product

- Defaulting on monthly/quarterly payment terms

- County court judgments and adverse credit information

- High staff turnover (particularly senior or finance staff) and/or repeated redundancies

- Unusual requests for contractual changes

- Unreliable management/financial information

- Evasive finance/credit staff

- Sector distress – most recently leisure, hospitality and energy sectors

- Late company filings

- Specific announcements to suppliers, customers, shareholders or stock market

- Unusual activity on site or premises

- Restructuring or refinancing.

What should you be doing?

One of the best examples of successful ongoing supply chain management was the construction of the Olympic Park and Athletes’ Village for the London Olympics in 2012. This project was successfully completed despite more than 50 distressed and insolvent situations in the construction supply chain.

The impact of those insolvency events was mitigated through decisive early actions like these;

| Early and ongoing due diligence | Due diligence at the outset of a trading relationship can provide a benchmark against which you can measure any deterioration in a trading relationship. |

| Contingency planning | If a customer has concerns about the ability of a key supplier to continue to make supplies, they should put in place a contingency plan in case of failure, to mitigate any adverse impacts, and migrate to a new supplier to ensure continuity.

Contingency plans should focus on identifying key trading partners and the customer’s ability to terminate their existing supply contract and what steps need to be taken to ensure as smooth as possible a transition to the new supplier. |

| Drafting of commercial terms and termination provisions | When negotiating supply contracts, customers should ensure they have adequate protection through termination provisions, rights to access information and reporting requirements, comprehensive retention of title provisions, clear and wide ranging ‘event of default’ provisions.

Customers should consider what powers are necessary in the worst-case scenario of an insolvency in the supply chain. |

| Ongoing stakeholder management and engagement | Keep direct contact with suppliers, customers and others so that you are informed of changes and/or deteriorations in the relevant sector. |

| Look for triggers and exploit leverage | Look for opportunities to exploit leverage to renegotiate terms, such as issuing winding up proceedings, withholding payments or supplies. |

| Consider rights on insolvency | Know the difference between liquidation and administration.

If a customer is owed money by the supplier, in most cases the customer is likely to be an unsecured creditor and so will rank behind any secured creditors in an insolvency. Often unsecured creditors make no recovery on the sums they are owed unless they have their own forms of security like Retention of Title in respect of any stock supplied or a designated If the customer is holding any of the supplier’s products, equipment or machinery, this could be used to create negotiating leverage for payment of the sums owed. Many contracts allow for termination where a counter-party becomes insolvent. Customers should look at what rights they have under their contract, and whether any applicable insolvency laws would prevent them from exercising those termination rights. |

| Close control of finances and debtor ledgers | Strong debt recovery procedures and teams are key to minimizing exposure to long term accrue liabilities. |

| Keep control and take action quickly | Keep a close eye on missed deliverables and payments and take action quickly as you may lose the right or ability to act if the supplier enters into an insolvency process. |