Corporate

In an ever-changing world, businesses faced with consistently uncertain financial and economic conditions, with markets which are more competitive than ever before, need solid corporate legal advice. We’re responsive and connected – helping you manage relationships with key stakeholders, navigating your business journey and identifying potential risks.

Key contact

Richard Wilkey

Head of National and London Corporate Teams

Leading corporate advice for businesses

Whether you’re starting up or scaling up, facilitating mergers and acquisitions or making exit plans, we put ourselves in your shoes to give commercial, pragmatic advice at every turn. The award-winning team also work internationally as trusted advisers, following our clients wherever they go and facilitating deals globally through our network of contacts.

Our clients

From PLCs and healthcare organisations to family-run or owner-managed businesses, our experience extends across the board. We’re part of some of the most important moments any business faces. Working closely with our Banking and Finance team, we provide a variety of funding solutions, including venture capital and equity investments. We can also guide you through setting up employee ownership trusts, employee incentive schemes and corporate structuring and reorganisations.

Our clients are varied; from healthcare providers, angel investors and management teams to international business, private equity backed companies and pension funds to name a few.

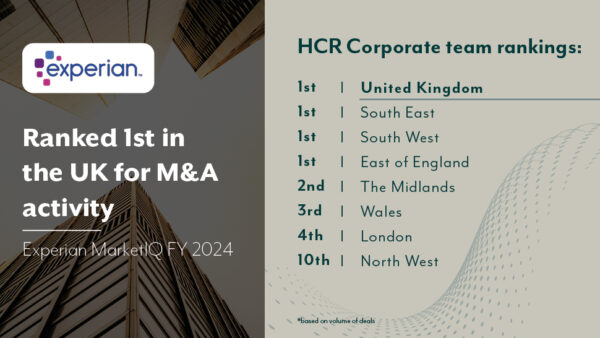

We’re consistently one of the top deal makers in the UK

HCR has consistently been ranked as one of the top three most active M&A advisors in the UK and RoI, for the last three years, according to Experian MarketIQ.

Need due diligence advice?

Our BRICS service is a pragmatic, commercially-minded advisory service focusing on the key issues facing bigger businesses that can either hold you back if you get them wrong, or truly maximise your position if you get them right. We advise on Business Risk, Investigation, Compliance and Secretarial.

BRICS will:

- Save you the headache of getting into hot water, by helping you avoid high-risk situations or noncompliance

- Help you manage your liabilities

- Maximise your position, by identifying opportunities and areas to exploit Make it easier for you to run your business day-to-day.